What is Specialist Insurance?

Specialist Insurance is a broad term that typically refers to insurance policies that are designed to address specific, unique, or niche risks that may not be adequately covered by standard insurance products. These specialized policies are tailored to the distinctive needs of certain industries, professions, or activities, providing more targeted coverage for specific risks and exposures.

Examples of Specialist Insurance include:

Event Insurance: Coverage for potential financial losses and liabilities associated with organizing and hosting events, such as conferences, weddings, concerts, or sports events.

Fine Art Insurance: Insurance specifically designed to protect valuable works of art, collectibles, and antiques against damage, theft, or loss.

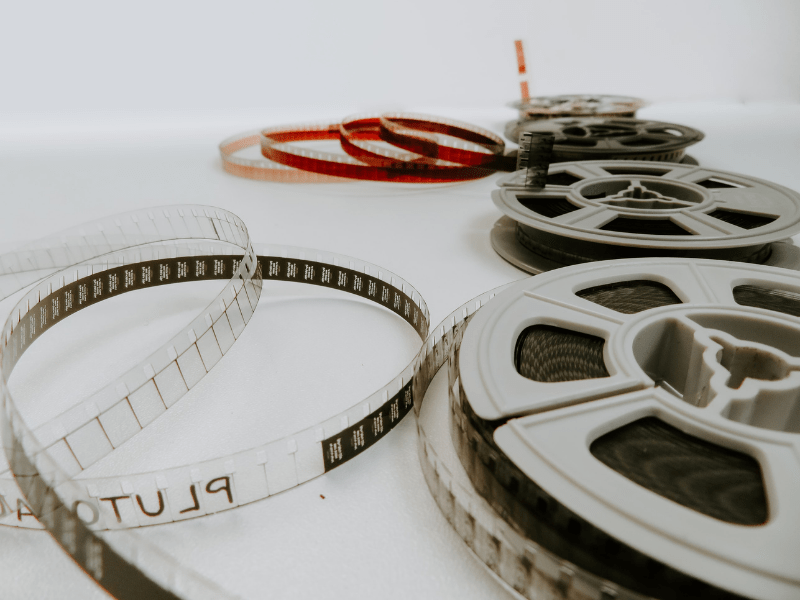

Film Production Insurance: Coverage for risks associated with film and television production, including equipment damage, liability, and other industry-specific risks.

Cyber Insurance: Protection against the financial losses and liabilities resulting from cyberattacks, data breaches, and other cyber-related risks.

Environmental Liability Insurance: Coverage for liabilities related to environmental pollution and contamination, addressing the costs of cleanup and legal responsibilities.

Kidnap & Ransom Insurance: Insurance designed to provide protection in the event of kidnapping, extortion, or related security threats, often sought by high-profile individuals and businesses operating in regions with security concerns.

Event Cancellation Insurance: Coverage for financial losses incurred due to the cancellation, postponement, or disruption of planned events, such as concerts, conferences, or weddings.

Political Risk Insurance: Protection against financial losses resulting from political events, such as government actions, expropriation, or currency inconvertibility, that may affect businesses operating in foreign countries.

Trade Credit Insurance: Coverage for businesses to protect against the risk of non-payment by customers due to insolvency or default.

Professional Indemnity Insurance: Coverage for professionals, such as consultants, architects, and lawyers, to protect against claims of negligence, errors, or omissions in the provision of their services.

The term “Specialist Insurance” can encompass a wide range of niche coverages, each designed to meet the unique needs and challenges of specific industries or activities. These policies often require a more nuanced understanding of the risks involved, and they may be tailored to the particular characteristics of the insured business or individual. Working with specialized insurance providers is common in this domain to ensure that coverage adequately addresses the specific exposures faced by the insured party.

Things to consider with Specialist Insurance

Here are a few additional points to consider about specialist insurance:

Risk Assessment: Specialist insurers typically conduct thorough risk assessments to understand the unique challenges and exposures faced by the policyholder. This assessment helps in tailoring the insurance coverage to specific needs.

Cost of Premiums: Because specialist insurance is designed to cover specific and often high-risk situations, the premiums for these policies may be higher than those for standard insurance. The cost is often reflective of the increased level of risk and the specialized nature of the coverage.

Policy Exclusions: It’s crucial to carefully review the terms and conditions of any specialist insurance policy. Some policies may have specific exclusions or limitations that policyholders need to be aware of to ensure they have a clear understanding of what is covered and what is not.

Regulatory Compliance: Depending on the industry or type of risk being covered, there may be specific regulations and compliance requirements. Specialist insurers should be well-versed in these regulations and work with policyholders to ensure compliance.

Claims Handling: In the event of a claim, the process for handling claims can vary between specialist insurance providers. Understanding the claims process and how efficiently and effectively claims are handled is an important aspect of evaluating an insurance provider.

Market Dynamics: The specialist insurance market can be dynamic, with changes in risk profiles, regulations, and market conditions. Staying informed about developments in the industry can help policyholders make informed decisions about their coverage.

Broker Expertise: Insurance brokers who specialize in specific industries or types of coverage can be valuable partners in helping individuals and businesses find the right specialist insurance. They can navigate the complex landscape of specialized coverage and help clients make informed choices.

Emerging Risks: As new risks emerge, specialist insurance providers may develop innovative solutions to address these challenges. Keeping abreast of emerging risks and the insurance products available to mitigate them is essential for staying ahead in risk management.

Always consult with insurance professionals and carefully read and understand the terms and conditions of any insurance policy before purchasing. This ensures that the coverage meets your specific needs and provides the level of protection you require.